Colorado Tax Credits

Leverage Your Investment

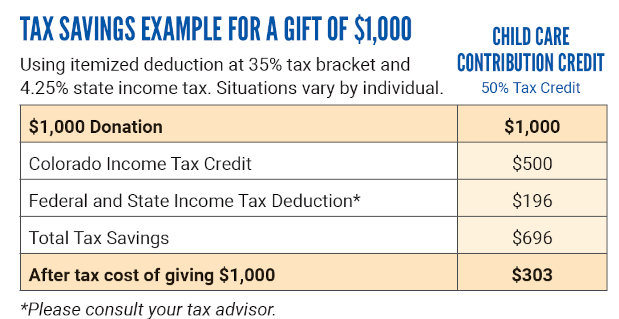

Child Care Contribution Credit

Mile High United Way is changing the odds for young children, and investments in high quality early education ensure a stronger, more vibrant economy - now and into the future. With your support through the Child Care Contribution Credit (CCCC), we partner with 39 organizations across Metro Denver, Boulder, and Broomfield to ensure children receive a strong start in every community, and parents can provide for their families knowing their children are in good hands. Your investment extends beyond high quality early care and also ensures that children have a safe place to go before and after school.

Your support provides more than 11,000 children with access to licensed child care facilities and training for more than 4,000 educators to enhance the quality of their educational programs.

- Gift of $250 or more -- Gifts under $250 will be moved to support our Child Care, Development & Education focus area and will not be eligible for the Child Care Contribution Credit tax creditDirected to a Mile High United Way CCCC eligible program or partner agency

- Eligible for 50% tax credit on state income tax

- Leverages federal matching dollars to improve the quality and availability of childcare in Colorado

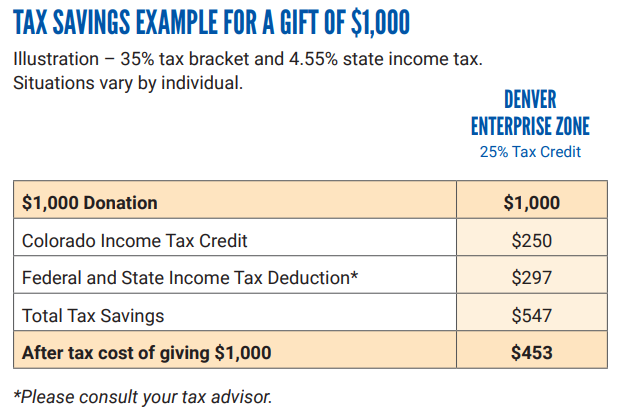

Denver Enterprise Zone

Mile High United Way is changing the odds for individuals across Metro Denver, and your support through the Denver Enterprise Zone (DEZ) tax credit plays a critical role in connecting people to resources during their times of greatest need.

Your gift helps save lives. By leveraging the DEZ tax credit, you are helping us fight for the education, health, and financial stability for everyone in Metro Denver, Boulder, and Broomfield. Mile High United Way programs eligible for DEZ tax credit include:

- United Neighborhoods (includes United for Business, United for Families, and United for Schools): creating opportunity within the highest need communities in our seven county footprint

- Bridging the Gap: supporting young people who aged out of the child welfare system with housing and a pathway towards a more stable future

For your gift to qualify for a DEZ tax credit, your gift must be at least $250 annually and be directed to a DEZ program or agency.

Tax credits associated any DEZ project may only be taken if the donor files electronically and provides Mile High United Way with their Colorado Account Number (Letter ID) or last four digits of their SSN.